The economy of Canada is still trying to regain its footing and bounce back fully. The uncertainty remains apparent, given the volatile prices and the still-recovering labor market. Worse, income and savings cannot suffice daily and urgent expenses at times.

Hence, it is no wonder that more people turn to higher interest-bearing loans, such as payday loans. In this article, we will talk about payday loans and their importance in the new normal.

Payday Loans in a Nutshell

Payday loans are high interest-bearing loans based on the borrower’s income. As the name suggests, these are instant loans repaid on the borrower’s next payday. Contrary to banks, payday loans are unsecured and do not need collateral. During the pandemic, it became more popular as uncertainties shook the economy.

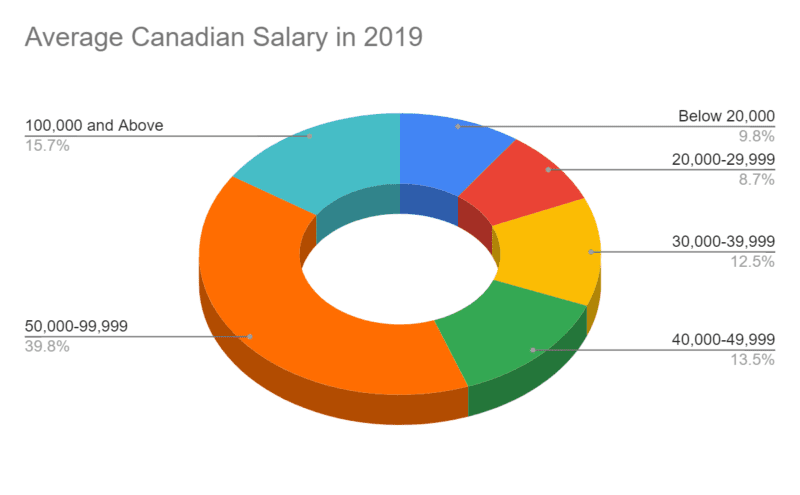

Moreso, there is no minimum income requirement to avail of payday loans. Hence, it is no surprise that many low and middle-income households run to them. Even before the pandemic, payday lenders are the go-to choice for many low earners. A study shows that over 50% of payday borrowers were from lower-income households. Since the average income in 2019 was $52,600, most borrowers were earning below $50,000.

Taken from Statista

Payday Loans During the Pandemic

During the pandemic, restrictions across the country disrupted most operations. Businesses in hard-hit industries either had to lessen their production or shut down. Given this, the unemployment rate skyrocketed to 13% amidst the volatile prices. As the recession peaked, the interest rates plunged, yet loan approvals remained stringent.

Moreso, expenses and borrowings ballooned as hospitalizations remained on the rise. Fortunately, payday loans were there to provide temporary financial relief to many Canadians. In a 2020 survey, 80% of borrowers in Toronto used the amount for their household expenses. Meanwhile, 40% of them said banks denied their applications.

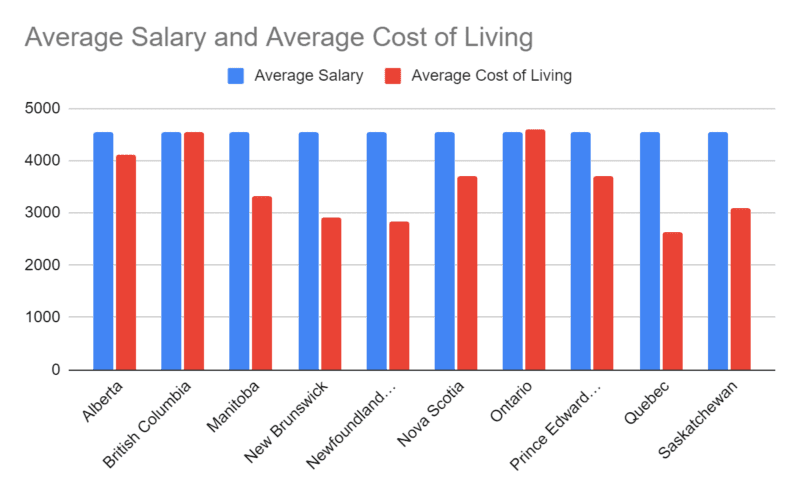

The average annual salary in Canada amounted to $54,630 in 2020. If we divide it into 12 months, the value will be $4,553. If we set the average across all provinces, it cannot suffice the average cost of living. For example, the average cost of living in British Columbia is $4,557. Hence, it affirms the fact that many borrowers are earning less than or within the average. It is a good thing that payday loans in British Columbia charge lower rates than in other provinces.

Taken from Nationwide Visas and Wowa

But, criticisms of the predatory tendencies of the payday lending industry persist. Despite this, many Canadians are availing of payday loans. With the helpful things they seem to offer, can they make up for the pitfalls?

How Payday Loans Help Many Borrowers Amidst Economic Uncertainties

What many people do not still understand is that payday loans are still a blessing in disguise. Amidst the job shortage and strict banking regulations, lower-income households survived. With payday loans, they were able to suffice their expenses while looking for jobs. Here are some of the advantages payday loans offer.

A Lifesaver Amidst the Crisis

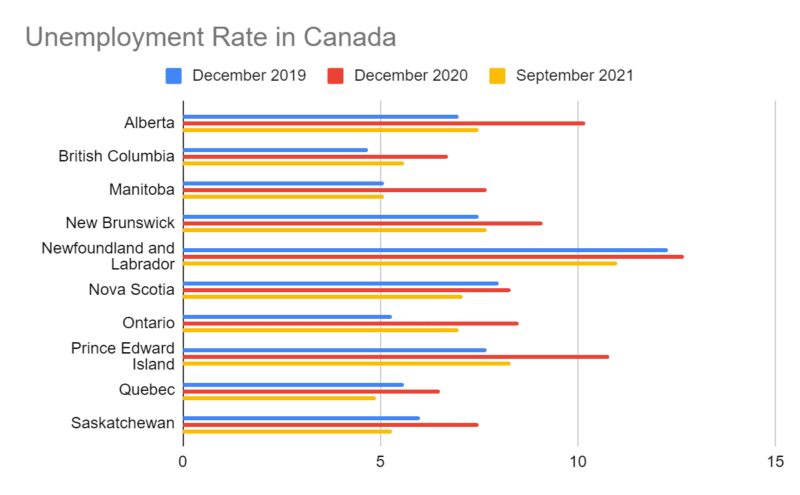

Perhaps you still do not realize how payday loans saved many households from hunger. From December 2019 to December 2020, the unemployment rate rose by 31%. The highest was in Ontario and Manitoba at 60% and 51%, respectively. We can only imagine how many businesses had to shut down and lay off employees.

In the new normal, the economy is recovering, and most are reopening. As the data shows, the unemployment rate decreased by 27%. Yet, it remains higher than the pre-pandemic level. It shows that 6.9% of Canadians in the labour force remain unemployed.

With payday lending, no minimum income is set to avail of loans. But, the interest rates may be higher than usual. Even so, it is better than having nothing at all. You can get approved even if you do not have a job yet, making it a more lenient choice.

Taken from Newfoundland and Labrador Statistics

Regulated/Authorized Lenders are Trustworthy

What most people do wrong is generalize payday lenders. In reality, abuses are typical among unregulated payday lenders. In recent news, borrowers in Nova Scotia have experienced harassment from payday lenders. Apparently, they have dealt with the unregulated ones.

Authorized lenders, in general, are trustworthy and fair. Their operations are always by the law, including bank access. With that, you must always know first whether a payday lender is authorized or not.

Short-term Financial Impact

The payment period is short, so is the financial impact. Once you pay the principal amount and the interest rates, you are clear then. On average, payday loans in Canada bear 17% interest rates. Good thing, payday loans in British Columbia charge lower rates at 15% on average. Hence, if you borrow $600 in other provinces, you will have to pay $702. But in British Columbia, you will pay a lower amount at $690.

Fewer Requirements

The best thing that payday loans can promise is their leniency with requirements. It does not require borrowers to have collateral for their loans. Hence, if they cannot pay their loans, the assets will remain untouched. Unlike in banks, applications are harder to approve, and collaterals are needed.

Moreso, it does not set a minimum income requirement. Instead, payday lenders set the amount they can lend based on your income.

Non-Discriminatory

Payday loans are non-discriminatory. Graduate or not, employed or not, white, brown, or black, you are free to apply. You are welcome to apply as long as you are at least 18 years old with complete documents and a bank account.

With the information provided, you can see the flip side of the coin. Amid controversies, payday loans remain a staple to many households in Canada. Yet, you still have to be careful, so you will not end up with higher charges and more problems. Make sure that they are authorized lenders, and spend your money wisely.