With online loan options increasingly expanding, the borrowing medium is evolving dramatically. In the aftermath of the financial crisis in 2008, a considerable volume of traditional banks shied away from consumer lending (that’s an understatement!).

Currently, more of these institutions are beginning to loosen their restrictions due to a health crisis affecting the country’s economy. Yet, they are still reluctant to provide unsecured loans.

In their place, online lenders are coming in to offer loans much more conveniently than a traditional bank. Where you would need to wait a few days or more for approval with the conventional method, online options offer approval the next day if you qualify. These are ideal for people who find themselves in emergencies. There’s no waiting and worrying, being held captive by the bank while enduring dire circumstances (and tapping your fingers waiting for the phone to ring).

Loans Move into the Modern Age

From personal loans to title loans, financial service companies are beginning to give traditional banking institutions a run for their money in the lending industry (pun intended!). People prefer the online medium, where an unsecured personal loan is assured with ease compared to the traditional lender—no complex forms or lengthy approval timeframes! The platform has been in existence for several years but it has been gradually gaining popularity.

Now with reputable choices being prevalent such as Prosper, OnDeck, and Titlelo, the market is taking off. The process is comparable to obtaining a loan in any type of scenario, but with minimal time or hassle. Lenders of today’s generation want to focus on a straightforward, user-friendly process with an answer provided almost instantly.

Typically, with a ‘brick and mortar’ bank, there is a delay even for those who do the application process online. There is someone who needs to take time to review the paperwork. The chances for approval decrease with a conventional lender due to the reluctance to loan to consumers with a lower credit score.

Online lenders are much more lenient with bad credit (cha-ching). These loan services employ alternate methods to determine the worthiness regarding credit, like debt-to-income ratio, utility bill installments, or even using data collected from social sites.

Remarkably for an unsecured loan, online lenders can provide their clients with better interest rates than the traditional institutions and smaller service fees if there are any at all. It’s possible because they have little overhead in comparison.

There is also no need for you to place collateral on an unsecured loan to be approved, deeming it much safer than other options. Defaulting on this loan won’t result in repossession or foreclosure.

Benefits of Online Loan Options

In using online loan lenders, there are benefits above and beyond the convenience than the traditional bank setting. Some people still prefer to do business person-to-person with the added benefit of privacy and a sense of security that you may not have over the web (no judgement if that’s you!).

But some people choose the online option based mostly on sheer up-to-date logistics compared to the antiquated practices still employed in the traditional platform, for example:

• Shopping Around: You have an opportunity to pick and choose among a variety of lenders comparing rates and terms before accepting the loan for you. It’s merely a matter of locating a service that offers you the best option.

• Prequalify with No Harm: Some lenders allow pre-qualification with no harm to your credit score by making only a soft credit inquiry (make sure you ask about this!). Once you’re ready to apply, you’ll need to have a hard inquiry. These do affect your score, but the impact is only slight.

• Timely and Efficient: It’s not as frustrating to do paperwork when you can do it at your leisure—in your home instead of racing through it in a financial establishment. Once everything is submitted, the review process is fast and funds can be deposited as soon as the same day or no later than the following business day.

Some lenders are more than willing to work with people who have less than desirable credit, so there is a possibility for approval if your credit score is not great. Some lenders specialize in this type of service, with even the potential for decent rates despite the rating.

But it’s important to note some lenders do target people with bad credit because they will hit the borrower with considerably higher interest rates and fees, making it challenging for them to return the money (run the other way!). These instances lead to debt traps that borrowers are unable to get out of, with often bankruptcies as the end result.

Final Thoughts

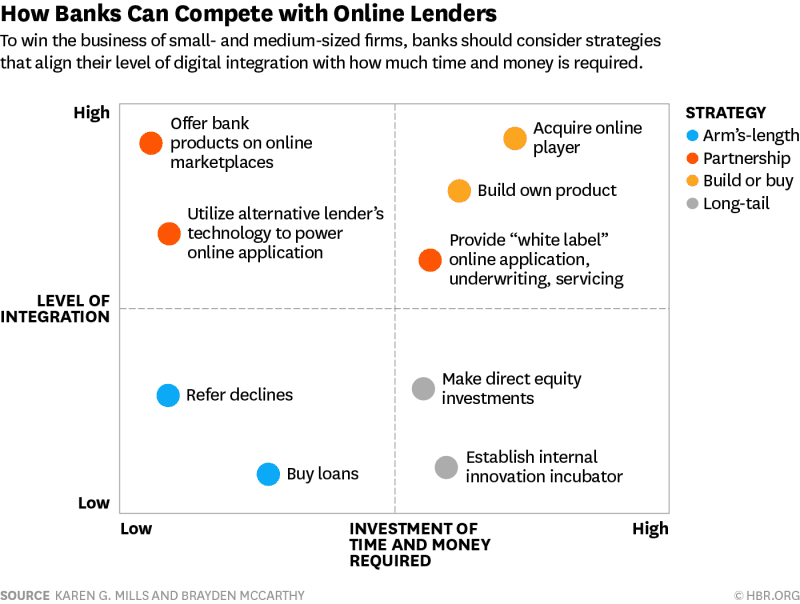

It’s always a good idea to do research when you’re shopping for a loan. It doesn’t mean you have to follow through with an online lender. In fact, some traditional banks are working hard to resemble online lenders!

Either way, shopping around will allow you to compare the different lenders for which you should consider the interest rates, fees, terms and monthly payments. Narrow the list down as much as possible and then prequalify with those lenders on your list if possible.

The digital age has simplified banking, where it was once a complicated, stressful ordeal with which to contend when taking loans. The modern online lending process creates no tension, bears no judgment and almost always allows approval. It’s completely changed the way people do their finances.