Being a fabulous, fashionable housewife also includes being on time, especially when Uncle Sam comes a calling. UGH! That inconvenient visitor always seems to show up at the most inappropriate time … during the season when we’re already dealing with spring cleaning, a new school semester, kids, cats and dogs, lions and tigers and bears, Oh My!

When it comes to filing our taxes, given all those confusing credits, the possibility of some missed deductions, paperwork up the wazoo, what’s a competent parent to do? While we may pass on this annoying responsibility to a qualified tax professional, we still have to provide them with all the necessary paperwork to make this whole process fly. Are we due tax credits for energy savings or improvements that we may have missed?

Self-Help From HomeSelfe

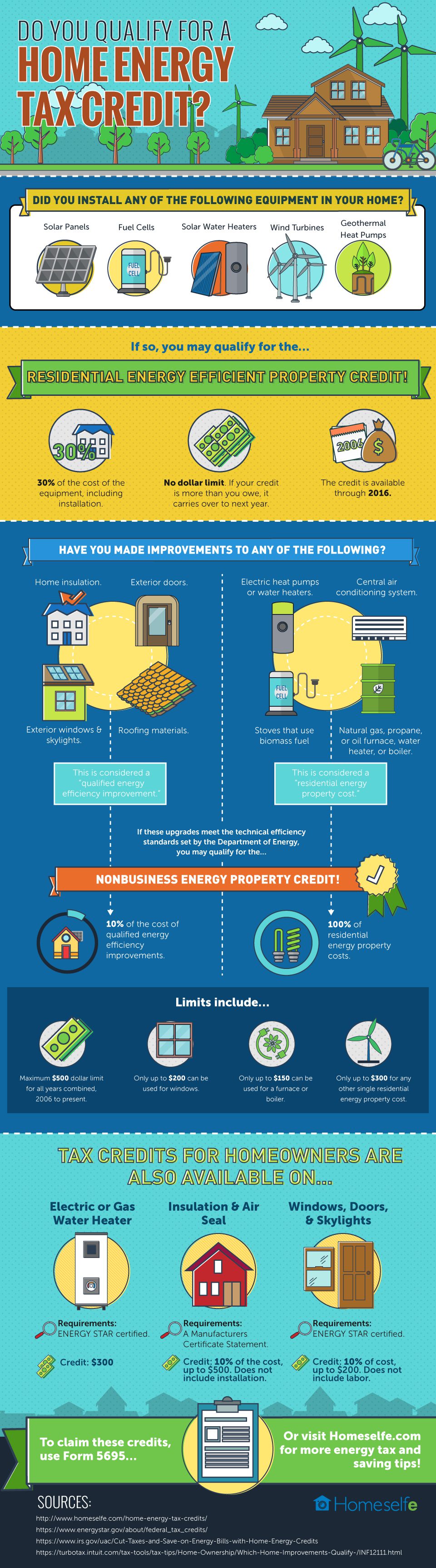

HomeSelfe, the makers of a free, home energy audit app have stepped up to the plate in order to help parents who are struggling with this exact type of dilemma. While their no-cost app concentrates on savings we could be overlooking in our home, they’ve provided us with an infographic that can recognize items we could be missing on our annual tax return instead of defining exactly what it means to be energy efficient.

Being An Energy Star ®

We all know that buying Energy Star ® appliances will save us money on our monthly utility bills in the long run, but what about other savings we could be getting from the government? These rebates often come with strings attached, strange stipulations, restrictions, and research that make them seem … like … too much work for too little of a reward … kind of like sunflower seeds!

Here’s where HomeSelfe gives us a quick glance at this complicated process in this infographic entitled, “Do You Qualify For A Home Energy Tax Credit?” This quick overview will at least give us some insight on what is worth our while when it comes to home improvements, replacements, and additions that could come in handy when filing our annual tax returns.