We all know that to be successful, you need money. But where do you get it? There are many different ways to make money, but one of the oldest is through investment. There are many different types of investments that you might hear about in conversation or on TV shows like Shark Tank and Dragons’ Den. Here’s a quick rundown of 13 common investment types.

Shares Or Stocks

Stocks and shares are the most popular type of investment. These investments work by an investor giving money to a company with the hope that it will increase in value, then selling at a profit. The most common form of investing is buying shares (stocks) in companies whose products and services you enjoy using every day. For instance, owning Apple stock would mean having an ownership stake in one of the world’s leading brands.

Bonds

A bond is essentially just like a loan. However, instead of lending money directly from your bank account, it’s done by purchasing bonds issued by someone else with their own money. In addition, bonds offer investors interest payments which can be very generous if you’re willing to risk your capital for more than five years.

Mutual Funds

A mutual fund is a special kind of investment that pools together the funds from many investors. And then invests those pooled resources into other securities such as bonds, stocks, real estate, or commodities to meet specific objectives for those who have invested in them.

Trusts

If you want to make sure your assets are passed on after your death but don’t trust anyone enough to accomplish this goal without making it expensive and complicated, setting up an irrevocable trust might be right for you.

Real Estate (property)

If you’re looking for a good return on your investment but also want to avoid taking too much risk, investing in property might be the choice for you. Real estate has always been a stable form of investment. The benefit of real estate is that you are not tied to one area if your investments do well. In addition, you may be able to make extra income from renting out any spare rooms or properties.

Cryptocurrency

In recent years more and more people and companies like bitalpha ai have been interested in digital currencies like Bitcoin or Ethereum instead of physical ones like gold and silver.

Gold And Silver

Some investors prefer having some of their money stored away as an asset that will retain its value even if it is not used daily (like a house). This can make sense, especially when severe inflationary periods make owning things with intrinsic value attractive from this perspective.

Art

Like real estate, art is a more challenging investment to make because you need some kind of expertise. It also requires an understanding of the market and whether or not it’s in demand from buyers.

Food

There are many ways that investors can invest money into food businesses these days, including purchasing products wholesale for resale at higher prices through restaurants or stores. And also by buying shares in larger companies with interests in this area or even investing directly into small-scale farms themselves.

Luxury Goods

Newer luxury goods offered include things like designer handbags which people might be interested in owning but only consider buying if they’re able to do so at a price lower than their original retail value.

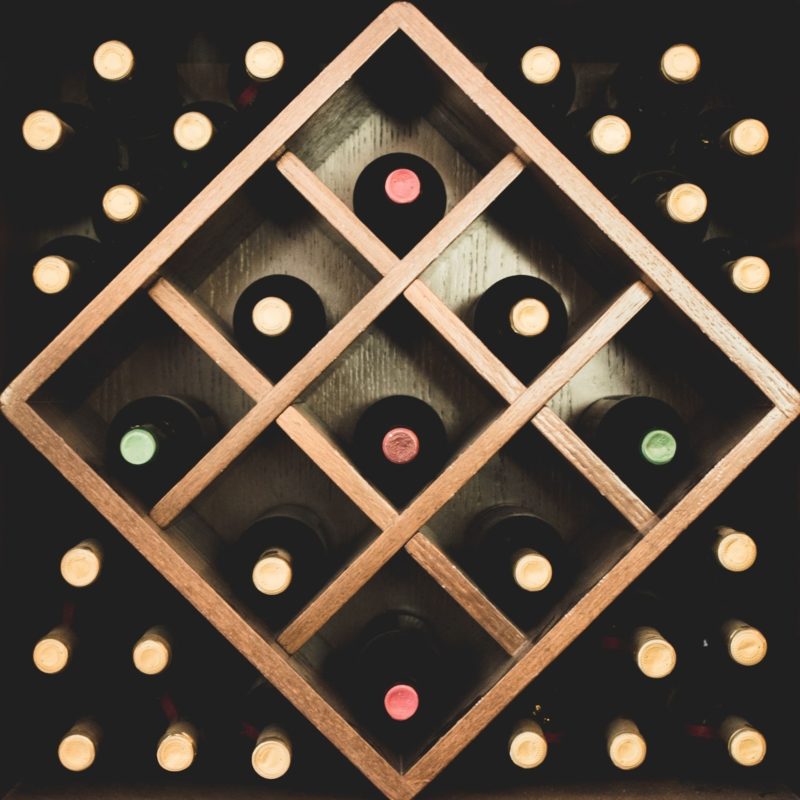

Wine

Unlike other investments, investing in wine is more about buying something for your own personal use (rather than an asset you expect to sell at a higher price). The reason? You can only drink it once.

Antiques

As with art, these kinds of assets are harder to invest in because they require some sort of expertise and understanding of the market.

Philanthropy And Donating Money To Charity

Many people might think that donating money or time will provide them no benefit. Still, there are actually many benefits associated with helping others out, like how it makes you feel good when you help someone else who needs assistance. Thus, putting your money where your heart is.

Investments can be incredibly complex and challenging to understand, but the main concepts are very simple. There is no one-size-fits-all method for investing. Every investor has their own unique set of goals that they strive towards and a specific personality type that will influence how they invest. Of course, there are many more than just thirteen ways to invest money, depending on your financial situation and what you want out of life. These examples should give you an idea of where to look next: long-term investments, short-term investments, real estate investing, stock market investing, gold investing, etc. The possibilities truly are endless.